Wage Theft & Misclassification

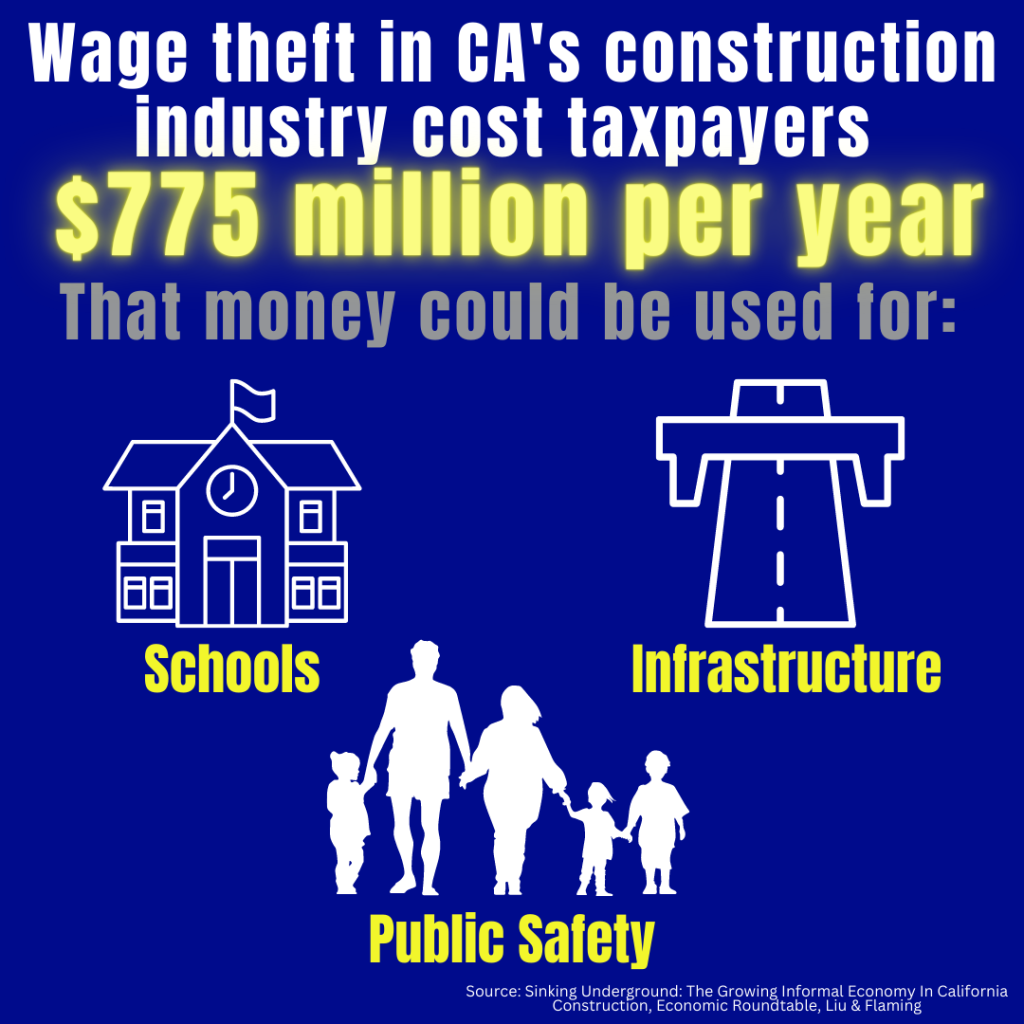

Wage theft and worker misclassification are illegal, and often have the effect of enabling contractors to artificially lower their project bids by failing to report and pay workers as required by law. In California’s construction industry alone, research shows these practices affect as many as one in six workers and costs California taxpayers as much as a billion dollars per year.

Common forms of wage theft and misclassification in the construction industry include:

- Failing to pay workers the required minimum or prevailing wage rates.

- Failing to pay workers for overtime, or denying them meal or rest breaks.

- Paying workers in cash, or “off the books.”

- Classifying employees as Independent Contractors to evade payroll tax, state disability taxes, unemployment, or workers compensation premiums.

Wage Theft and Misclassification don’t just negatively impact workers and taxpayers. They put honest contractors at a competitive disadvantage against those who knowingly violate the law.